IoT Analytics has published a new analysis that highlights 10 emerging IoT trends driving market growth.

This analysis is derived from the comprehensive “State of IoT – Spring 2024” – a report on the current state of the Internet of Things, including market updates and projections, the latest trends, market sentiments, investments, M&As, industry expert opinions, and more.

Key Insights:

- According to the latest State of IoT – Spring 2024 report, IoT remains a top-three corporate technology priority.

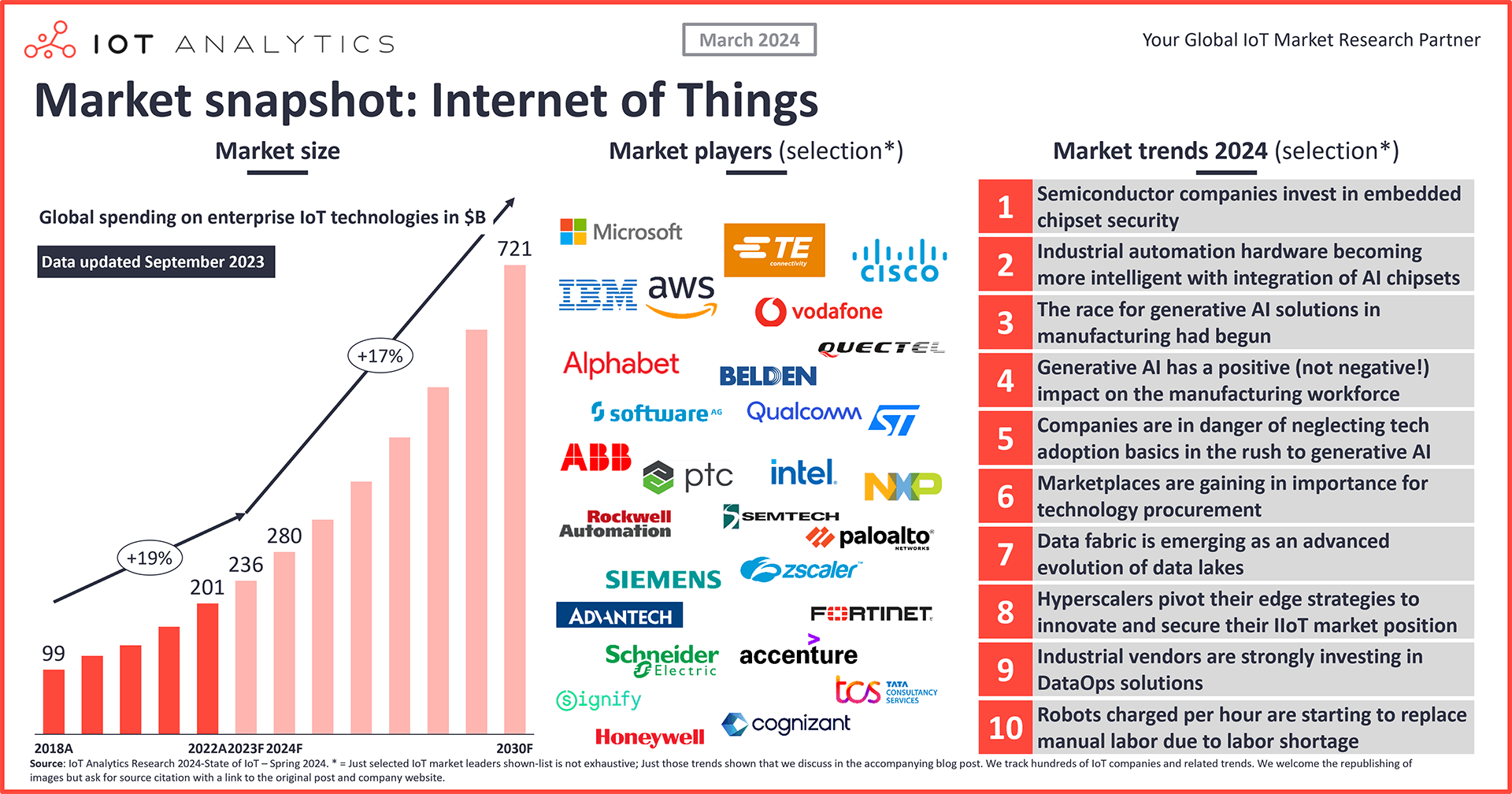

- While AI has surpassed IoT in corporate prioritization, combining IoT and AI is on the rise and seen as a tailwind for the $236-billion IoT market rather than a disrupter.

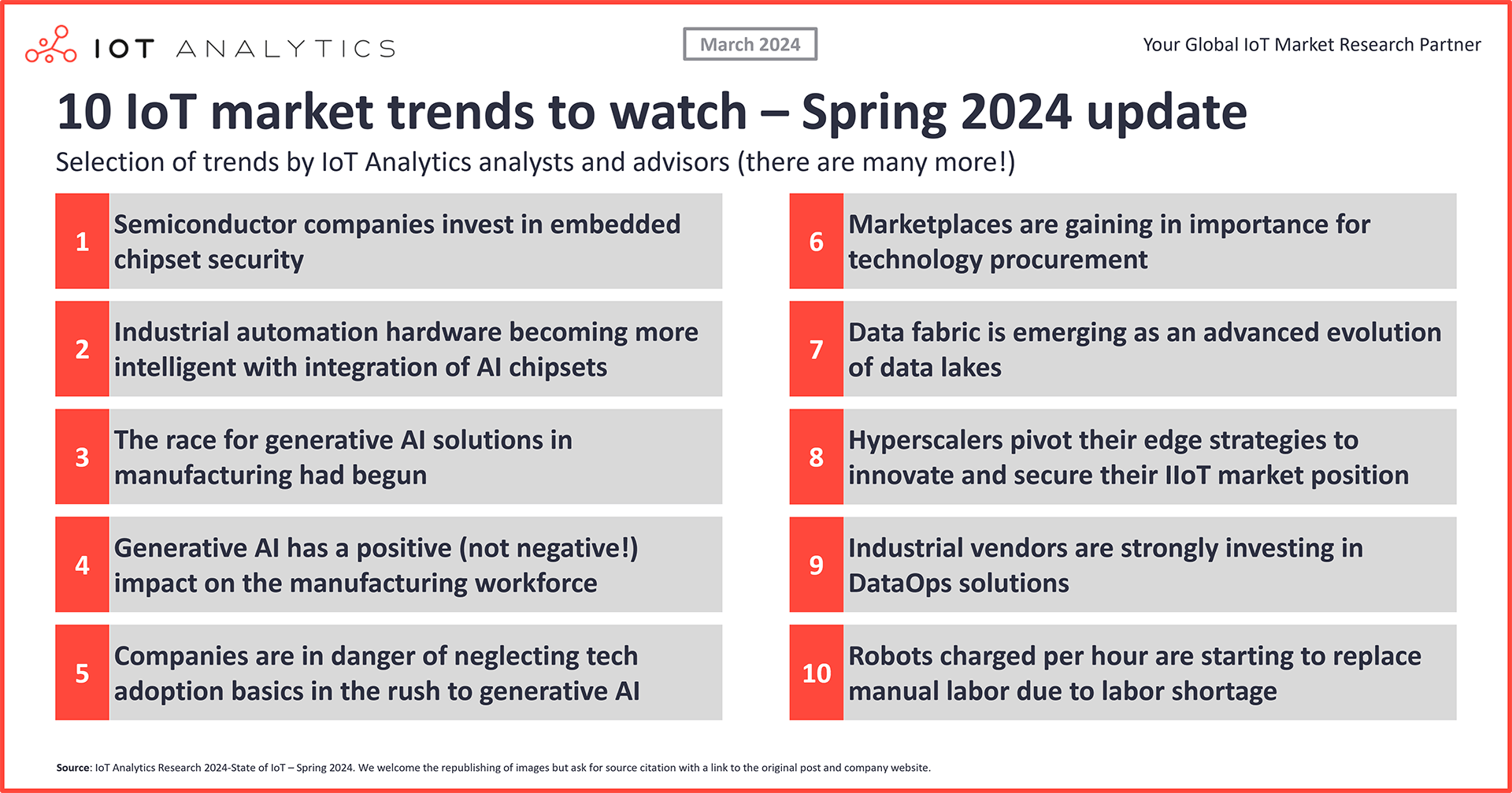

- IoT Analytics identified 40+ current IoT market trends in this research, 10 of which are shared below.

Key Quotes:

Knud Lasse Lueth, CEO at IoT Analytics, remarks:

“In 2023, the IoT market demonstrated significant resilience among economic fluctuations and geopolitical tensions. We now estimate a robust growth of 17% per annum through 2030. This growth is fueled by an increase in connected assets and corresponding investments in AI and cybersecurity within the IoT sector.”

IoT remains a top corporate priority on the back of the current AI wave

IoT remains a top priority. IoT remains a top-three corporate technology priority while AI has taken over as the top technology priority, according to the latest 148-page State of IoT – Spring 2024 report. In recent surveys from PWC, KPMG, and BCG, respondents ranked IoT second or third after AI in terms of investment prioritization for emerging technologies, with AI coming in first across the board.

AI is a tailwind for IoT. The latest research finds that the growth of AI is a strong tailwind for the $236-billion IoT market, as companies are gaining interest in both AI and IoT within their organizations. One indication is from IoT Analytics’ analysis of company earnings calls: since Q3 2022, the mention of these two technologies in the same earnings call rose by 61%.

40 current trends identified by the IoT Analytics team. IoT Analytics’ market analysis relies on the valuable findings of its research analyst team and input from industry experts and advisors. These professionals contributed greatly to the spring 2024 State of IoT report, which showcases nearly 40 IoT market trends, along with IoT market data, recent IoT news and developments, and the performance and activities of IoT companies. The analysis shows that AI is not the only trend that will help drive the IoT market—10 of the trends discussed in our report can be found below.

IoT market expected to continue its growth path. IoT Analytics assesses that the 10 trends discussed in this article (among many more) will contribute to an IoT market CAGR of 17% until 2030, which is a cautious downward revision from the forecasted 19% CAGR in early 2023 but nonetheless a testament to the strength of the technology and its impact in a variety of markets.

CEO quote: “In 2023, the IoT market demonstrated significant resilience among economic fluctuations and geopolitical tensions. We now estimate a robust growth of 17% per annum through 2030. This growth is fueled by an increase in connected assets and corresponding investments in AI and cybersecurity within the IoT sector.” – Knud Lasse Lueth, Chief Executive Officer

Spring 2024 macro environment outlook: Lingering economic uncertainty, but IoT remains a key investment

Inflation coming down. The high inflation rates that we saw in 2023 seem to be subsiding. The Euro area inflation estimate for January 2024 was 2.8%, down from 2.9% in December 2023. In the US, consumer inflation has greatly eased from its peak of 9.1% in June 2022; it currently stands at 3.2% in February 2023. In Asia, some countries witnessed their lowest inflation levels since 2022.

Muted global economic growth projections. However, despite inflation progress, global economic growth projections are still below the historical annual average. The IMF forecasts a 3.1% global economic growth in 2024 and a 3.3% growth in 2025. Additionally, by December 2023, China—the second-largest economy and the country with the most connected devices—experienced its longest deflation streak since 2009, with prices declining for the third consecutive month. On the flip side, India’s economy has been outperforming the rest of the world.

IoT markets affected, but positive sentiment shows. The IoT market has seen positive economic news lately. Going into 2024, the Global Supply Chain Pressure Index is back to its long-term average, indicating a normalization of supply chains after stormy times during the pandemic. Additionally, business sentiment around IoT appeared overall positive, and many IoT companies reported significant year-on-year growth in both revenue and gross margin within the IoT sector in Q4 2023 (e.g., Supercom, Lantronix, and Globalstar). Unfortunately, some IoT companies have reported revenue declines and market weakness.

Analyst quote: “India has emerged as the ‘new China’ in terms of growth outlook.” – Philipp Wegner, Principal Analyst—Data

With this market backdrop, the following is a list of 10 notable IoT and tech-related trends and opinions identified by the IoT Analytics team as part of the research for the report with accompanying commentary:

Trend 1: Semiconductor companies invest in embedded chipset security

Semiconductor companies are increasingly investing in embedded chipset security to address the growing security threats IoT devices face. Securing hardware at the chipset level with secure elements and physical unclonable functions (PUFs) can help protect data flowing from edge devices to the cloud.

Example: The ecosystem of US-based semiconductor company Intel is growing with security partners like US-based digital authentication company Intrinsic ID. In February 2024, Intel Foundry added Intrinsic ID to its Accelerator IP Alliance program, aiming to ensure the availability of hardware-based root-of-trust solutions for the Foundry’s members. Accepting that security and reliability are valuable for applications, the Foundry opened access to Intrinsic ID’s QuiddiKey X00 product family of root-of-trust (RoT) solutions, which use standard SRAM as a PUF to generate a hardware RoT without needing additional security-dedicated silicon.

Analyst quote: “Semiconductor companies are at the forefront of tackling [the growing security threats IoT devices face], focusing on investing in embedded chipset security, as hardware forms the foundational layer.” – Satyajit Sinha, Principal Analyst – Connectivity and hardware

Trend 2: Industrial automation hardware is becoming more intelligent with the integration of AI chipsets

With the advancement in AI technology, companies are now looking to leverage AI at the edge, increasing the demand for real-time data analytics also at the edge. AI chipsets are also becoming smaller in size while growing in power. This trend has led to the emergence of IPCs and gateways embedded with AI chipsets, resulting in edge AI equipment that can perform parallel computations and train algorithms with very low computational response latency.

One benefit of using AI chipsets at the edge is the acceleration of data processing directly on the industrial equipment. This, in turn, reduces network traffic and enhances security, as the amount of data going to the cloud for processing is reduced.

Example: At SPS in November 2023, Germany-based automation and digitalization manufacturer Siemens presented its SIMATIC IPC520A Box PC embedded with 6-core NVIDIA Carmel for edge capabilities and NVIDIA Jetson Xavier NX GPU for A, making it suitable for AI-oriented operations. The IPC520A is designed to work seamlessly with AI-based applications across various industries, including factory automation and logistics.

Analyst quote: “Advancements in AI chipsets specifically designed for the edge are noteworthy. Embedding AI chipset in edge hardware such as IPCs and gateway is bringing decision-making closer to the edge and opening doors to new IoT applications such as machine vision.” – Kalpesh Baviskar, Market Analyst—Connectivity and hardware

Trend 3: The race for generative AI solutions in manufacturing has begun

Many industrial generative AI (GenAI)-based solution showcases are popping up. Vendors in the industrial and manufacturing space are racing toward developing GenAI-based solutions around coding, troubleshooting/support, operational analytics, and generative design, among others.

Examples: The following are just two of the six showcase examples found in the State of IoT – Spring 2024 report:

- At SPS 2023, Germany-based automation technology company Beckhoff showcased its TwinCAT Chat for the TwinCAT XAE engineering environment. The TwinCAT Chat Client enables AI-supported engineering to automate tasks such as the creation or addition of function block code, code optimization, documentation, and restructuring.

- In November 2023, Canada-based industrial AI software company Canvass AI announced the next evolution of its industrial AI software with Hyper Data Analysis. Through the use of GenAI, the Canvass

AI software now incorporates learnings from text and visual-based data—adding it to production data streams—to advance traditional time-series-based AI insights for applications such as visual inspection, predictive maintenance, and quality within the process industries.

Analyst quote: “15 industrial automation and related vendors at SPS 2023 told us that GenAI is currently one of their top technology priorities. Moreover, we observed that these GenAI-based solutions are mostly in the stage of showcasing their capabilities rather than being widely available to the public. We believe this is to evolve in the coming months when vendors will go ‘live’ with these products for purchase.” – Fernando Brügge, Senior Analyst—Industrial IoT and AI

Trend 4: Generative AI has a positive (not negative!) impact on the manufacturing workforce

The race to integrate GenAI solutions in manufacturing—and how it differs from other technologies so far—revolves around the speed of adoption and the level of investment in the technology. Within three months of its public launch, ChatGPT reached an estimated 123 million users, an incredible feat for a new type of product. Additionally, soon after ChatGPT’s launch, Microsoft made a $10 billion investment in OpenAI, helping increase ChatGPT’s profile. This investment also showed the seriousness big tech companies like Microsoft are placing in this technology, leading companies across industries to question how they could leverage GenAI in their processes.

Adoption of new technology in manufacturing is often associated with negative impacts on the workforce. However, GenAI adoption in manufacturing is expected to boost employment and upskilling, shifting focus from automation to strategic growth. With GenAI contributing potentially $2.6–$4.4 trillion to the global economy annually, according to McKinsey, manufacturers are likely to deepen their investment in AI technologies.

However, AI’s impact on the workforce appears counterintuitive to common automation narratives. According to the Manufacturing Leadership Council, 32% of manufacturers anticipate an increase in headcount due to AI, suggesting that AI will create new roles and require upskilling rather than just automating existing ones. With 96% of manufacturers projecting increased investment in AI, there is a clear trend toward embracing AI for cost savings, growth, and revenue generation.

Emerging roles will likely include AI strategy managers and data specialists, reflecting a shift toward higher cognitive work.

Advisor quote: “The urgency for upskilling is underscored by the current lack of a dedicated AI training budget in 65% of manufacturing firms, signaling a potential increase in investment in human capital.” – Jeff Winter, Industry 4.0 expert and advisor

Trend 5: Companies are in danger of neglecting tech adoption basics in the rush to generative AI

GenAI is everywhere. Vendors are looking for ways to implement it in their products or to create new ones, and end users are eager to adopt. This rush, however, is not always helpful when it comes to adopting new technologies. The hype can often shift the mindset of adopters and vendors alike from “What technology should I use to alleviate X pain point?” to “How should I use this technology to alleviate some (sometimes non-existent) pain point?”

In almost all the surveys that IoT Analytics conducts—be it about IoT use case adoption, Industry 4.0, IoT software, or similar—“having a set goal” is always on the list of success factors that respondents mention. This is often forgotten whenever a new technology promises to “change the way we work” (the metaverse, for example).

Analyst quote: “[AI] should be treated like any other technology. First, think of the why, who, and how before deciding on implementing it. Second, if you are a (software) vendor, you should also keep in mind that being fast to innovate is not always the most important factor to keep your customers happy.” – Dimitris Paraskevopoulos, Senior Analyst—Quantitative data

Trend 6: Marketplaces are gaining in importance for technology procurement

Companies and sellers alike are embracing the subscription-based economy and seeking to simplify the procurement process. In January 2024, IoT Analytics published an article delving into the rise of B2B marketplaces, noting that B2B marketplaces are the fastest-growing procurement channel for software.

Analyst quote: “Cloud hyperscaler marketplaces currently lead in cloud-based software spending since many businesses have already committed cloud spending that can be utilized to procure software from these platforms.” – Justina-Alexandra Sava, Market Analyst—Software

Trend 7: Data fabric is emerging as an advanced evolution of data lakes

Though a relatively new term, data fabric describes a comprehensive data integration and management framework. It encompasses architecture, management tools, and shared data sets and is designed to assist organizations in handling their data.

Data fabrics differ from data lakes in that they go beyond storing raw data and from data warehouses in that they handle only processed or refined data. A core benefit of data fabrics is they offer a cohesive, consistent user interface and real-time access to data for all members of an organization, regardless of their global location.

Examples:

In 2023, several large data management vendors either upgraded their already existing data fabric solutions or launched new solutions:

- In February, US-based data integration platform provider Talend—one of the early users of the term data fabric—announced upgrades to their Talend Data Fabric solution, which was initially launched in 2015.

- In May 2023, US-based technology and software company Microsoft introduced Microsoft Fabric and launched it in November.

Analyst quote: “Given the increase in data complexity because of the exponential growth in big data, propelled by hybrid cloud, AI, IoT, and edge computing, there seems to be a good opportunity for vendors [offering data fabric].” – Mohammad Hasan, Market Analyst—Software and cloud

Trend 8: Hyperscalers pivot their edge strategies to innovate and secure their IIoT market position

Cloud providers are strategically adapting to the evolving IIoT market. In recent developments within the IIoT landscape, important shifts have occurred among major cloud service providers, with more focus on edge and containerization strategies.

Examples:

- Microsoft pivots its Azure IoT strategy toward Kubernetes. Microsoft has notably redirected its strategy toward Kubernetes, a move signaling a pivot within its Azure IoT Operations offering. This transition, accompanied by organizational restructuring and the discontinuation of the Azure Certified Device Catalog, highlights how Microsoft’s IoT strategy seems to evolve as technology and market dynamics shift.

- Google ends IoT Core but keeps Manufacturing Connect via Kubernetes. Similarly, Google’s decision to terminate its IoT Core offering in August 2023 has prompted attention. Despite this closure, Google’s IIoT solution, Manufacturing Connect, remains viable through its Kubernetes-compatible architecture, a strategic alignment reflecting the company’s technical prowess in this domain.

- AWS boosts IIoT investment with Sitewise and Monitron enhancements. AWS seems to double down on the IoT edge, which is particularly evident in the revitalization of Sitewise and other offerings like Monitron.

Advisor quote: “As the IIoT market evolves, cloud giants like Microsoft, Google, and AWS are moving further to the edge by embracing Kubernetes and enhancing edge computing capabilities. Their strategies revolve less around serving individual use cases themselves but rather participating in the edge (software) platform layer, which serves as the basis of digitalization for their partners and customers.” – Matthew Wopata, Edge solutions expert

Trend 9: Industrial vendors are strongly investing in DataOps solutions

Several vendors are investing in industrial DataOps solutions to tackle data integration and analysis challenges.

Industrial DataOps is an approach to data integration focusing on enhancing data quality through contextualization and modeling. This approach is experiencing growing attention within the industrial connectivity space.

Examples:

Some of the key vendors that offer industrial DataOps for data contextualization and modeling include:

- New vendors: Cognite – CDF, HighByte – Intelligence Hub, Prosys – OPC UA Forge, Litmus – Litmus Edge, Element – Unify, and Crosser – Flow Studio

- Industrial incumbents: ABB – Ability Genix, Aveva – PI System, Aspentech – Inmation, GE Digital – Asset Modeler, and Halliburton – DecisionSpace 365

Analyst quote: “In the world of AI, OT data stands as the cornerstone. It’s the quality and context of this data that truly empowers insights. We are seeing vendors aggressively advance DataOps tools for modeling and contextualization, with both new entrants and established OEMs perfecting their solutions. This concerted effort underscores the pivotal role of enhancing the quality of data from varied assets/software in unlocking digital transformation’s full potential.” – Anand Taparia, Principal Analyst—Industrial IoT

Trend 10: Robots charged per hour are starting to replace manual labor due to labor shortage

Manufacturing companies can benefit from equipment as a service (EaaS) by replacing labor-related operational expenses with another type of operational expense: robotics as a service (RaaS). RaaS is a relatively new business model, where a robot is provided by a machine builder on an outcome-based basis (paying per parts produced with the equipment) or runtime basis (paying per hours of equipment used) instead of as a direct purchase.

Example: US-based truck trailer chassis manufacturer Cheetah Chassis chose to hire welding robots per hour and explained that it could not find enough welders to fulfill demand. Its CEO, Garry Hartman, explained that it had trialed robotics before, but it was unsuccessful because it did not have the capacity to program and service robots. With RaaS, Cheetah Chassis can now enjoy the benefits of robotics without having to do so because it is provided by the RaaS vendor.

Analyst quote: “Companies are more likely to consume equipment by the hour if they are trying to fill in the gaps in the workforce (which is already paid by the hour) rather than purchasing new equipment.” – Matthieu Kulezak, Senior Analyst—Industrial IoT

Conclusion

The IoT sector is undergoing transformative changes. The new 148-page State of IoT – Spring 2024 report highlights the continuous evolution and resilience of the IoT market, driven by technological advancements and strategic shifts.

The shift of hyperscalers towards edge and containerization strategies, the integration of AI into industrial automation, the advent of generative AI in manufacturing, and the rise of data fabric solutions represent just a few of the dynamic developments redefining the enterprise IoT ecosystem. These trends, alongside other market data in the report, not only reflect the current state of the market but also provide a glimpse at future growth and innovation.

In navigating this landscape, it is crucial for businesses to stay informed and adaptable. With a projected CAGR of 17% until 2030, the potential for growth and transformation in the IoT sector is immense.