Berg Insight, the leading IoT market research provider, today released new findings about the market for Electronic Monitoring (EM) of offenders.

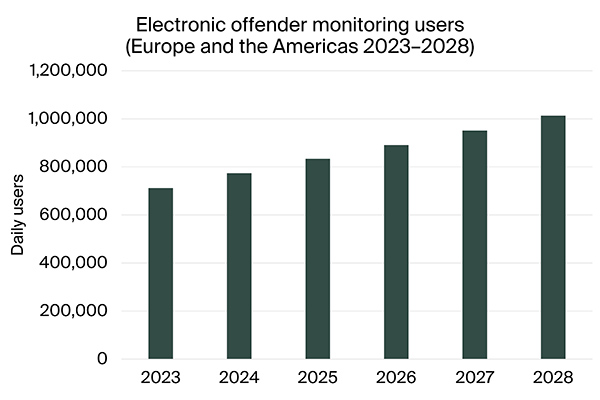

The number of simultaneous participants in EM programmes in Europe, North America and Latin America amounted to about 64,000, 518,000 and 130,000 respectively at the end of 2023. The total number of EM programme participants during the full year 2023 reached 200,000 in Europe, 880,000 in North America and 296,000 in Latin America.

Berg Insight estimates that the number of simultaneous participants will grow to 94,000 in Europe, 680,000 in North America and 239,000 in Latin America by the end of 2028. The market value in 2023 reached US$ 226 million in Europe, US$ 1.3 billion in North America and US$ 76 million in Latin America. The total market value in the three regions combined is forecasted to grow at a CAGR of 7.2 percent from US$ 1.6 billion in 2023 to US$ 2.3 billion in 2028.

Electronic monitoring (EM) programmes were first introduced in the US in the early 1980s. Today, EM is an established alternative to detention across Europe and North America and in some Latin American countries. The aim of EM programmes is to increase offender accountability, reduce recidivism rates and enhance public safety by providing an additional tool to traditional methods of community supervision. Policy makers, corrections authorities and private sector service providers advocate for extended EM programmes to reduce total correctional system costs and to combat prison overcrowding.

There are two dominant technologies used for electronic monitoring – Radio Frequency (RF) and GPS. RF-based systems are today the most common type of solution in most European countries, although the share of GPS devices is growing in many countries. In the US, Brazil and other countries in Latin America, GPS-based solutions are used in the vast majority of cases. A number of private companies are involved in the provisioning of EM, including developing, supplying and installing equipment, providing monitoring services as well as delivering other supporting services. Leading providers of EM equipment and services include US-based BI Inc. (GEO Group), Allied Universal Electronic Monitoring, Sentinel Offender Services, SCRAM Systems, Securus Technologies, Shadowtrack and Track Group; UK-based Buddi; Israel-based SuperCom; Poland-based Enigma (COMP); Switzerland-based Geosatis; and Brazil-based Spacecom and Synergye.

“The adoption and use of electronic monitoring solutions in the criminal justice sector is increasing as new products and solutions are being introduced that enable additional use cases”, says Martin Backman, Principal Analyst at Berg Insight.

Newly launched wrist-worn GPS devices reduce the stigma associated with ankle bracelets and can be used for low-risk offenders. Devices that combine GPS tracking and alcohol monitoring are also being introduced and are increasingly used as part of EM programmes. The developments in tracking technology and software in the past few years have made it possible to create dynamic inclusion and exclusion zones that protects the victims of domestic violence from the perpetrator. Victim protection solutions are now also part of the EM programmes in many countries and jurisdictions.

Mr. Backman concludes:

“EM programmes are expected to increase in size in the next few years as prison overcrowding and rising incarceration costs continue to impose major challenges for many jurisdictions in Europe and the Americas.”